Leading B2B companies are using digital to power sales and profit growth

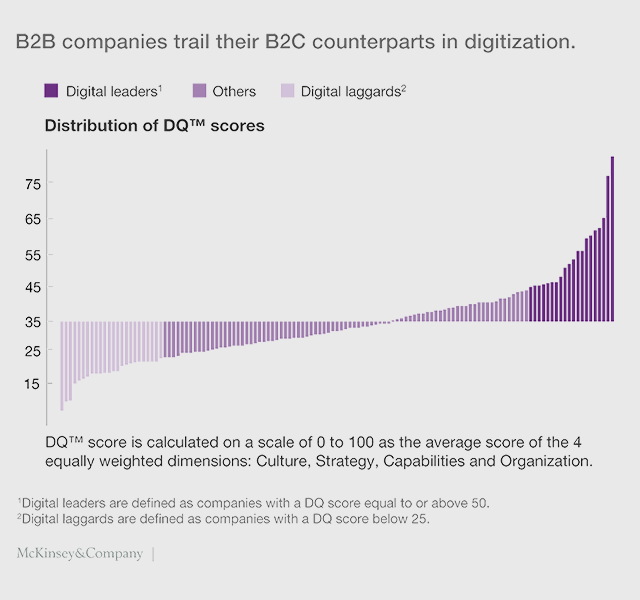

Over the past few years McKinsey has been measuring and evaluating the impact and potential that Digital can have for B2B companies. Digital has been a main preoccupation for B2C companies for a number of years, but B2B companies are now also waking up to the opportunities Digital can bring.

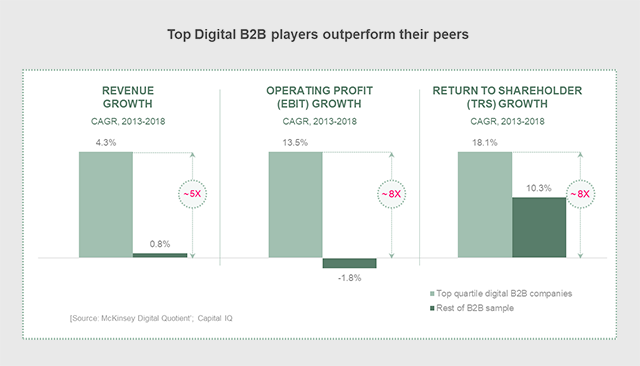

Part of the McKinsey survey has been to assess how ready a company is for Digital Transformation and how developed are its skills and systems to take advantage. There are a number of successful B2B companies who have developed strong Digital capabilities. Organisations like Cisco, Boeing, Wolverine, Ford, Caterpillar, Texas Instruments and others. But most lag the B2C average and closing that gap is going to be crucial. Top-quartile Digital performers grow more sales, earn more profits, and deliver more value to shareholders than the rest of the B2B field.

Some of this is not a complete surprise, of course, since the digital ecosystem can be tougher to establish and navigate for B2B companies. Their sales forces face, for example, a far more complex purchasing environment, with multiyear deal cycles in some cases, lengthy RFP processes, and the involvement of many vendors, decision makers, and influencers.

While these complexities are significant, it would be a mistake to use them as an excuse for falling short in some key areas. Digitisation has made consistent, high-quality customer interactions a competitive differentiator. Right now, however, selling models remain largely hitched to offline channels. It’s hard for business buyers to get the pertinent and personalised information they need and want from supplier websites and social platforms and harder still to buy directly (though often that is a supplier’s intentional strategy).

In addition, while B2B sales teams are working harder to close deals that often involve multiple rounds and many more decision makers, they often lack the real-time analytics and digital tools they need to manage the sale profitably by knowing whom to court with what offer or when to conduct personal outreach.

Incremental changes or pilot efforts can provide benefits, but they aren’t likely to significantly close the gap.

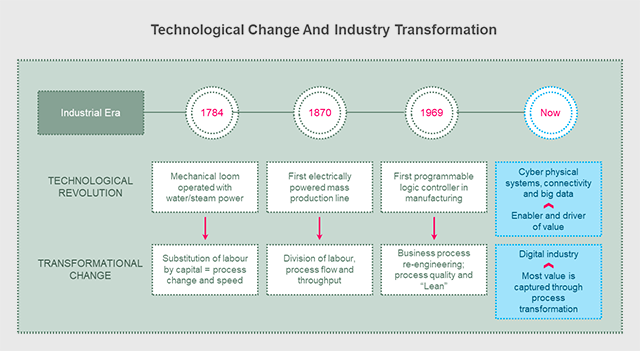

Leading B2B companies however do embrace an “all in” digital strategy, knowing it’s crucial for making needed core changes. And they don’t focus on just digitising sales and customer interactions, but on harnessing digital assets internally to enable their teams to perform better. “Industry 4.0” has become a byword for a full-on review of how digital tools and solutions can unlock significant performance gains across the whole supply chain through automation, real-time connectivity and data and predictive maintenance.

PWC found that Industrial leaders are planning to commit up to $1trillion to Industry 4.0 –around 5% of revenue p.a. A major focus of these investments will be on digital technologies like sensors or connectivity devices, and on software and applications like manufacturing execution systems.

Companies like Ford, Caterpillar, Wolverine, Cisco, Siemens, Bayer, Samsung and others are committing to digital transformation because customers are demanding it, competitive pressures are forcing it and they realise that driving through these changes can uncover new sources of profit and revenue growth. They are also very aware of these sort of market findings:

81% of Purchasing/ Procurement Managers said they would choose a supplier that offers an online ordering option over an equal supplier who does not. The reasons were: (i) do business at our convenience, (ii) save time, and (iii) easily monitor order status

Hybris

B2B e-Commerce in the US alone is set to reach $9 trillion in 2019 including through business networks and EDI as well as suppliers‘ e-commerce sites

Forrester report

65% of B2B companies in a recent Oracle survey said they now sold direct using e-commerce and 80% of companies in that survey said that they are now actively reviewing this opportunity, whether to launch or invest further

Oracle

68% of companies said that mobile has become a key catalyst and had changed the way distributors and customers wanted to connect and trade

Forrester /JP Morgan report

50% of total sales are predicted through e-commerce by B2B companies. A number are claiming average growth rates of up to 30% +

Forrester /JP Morgan report

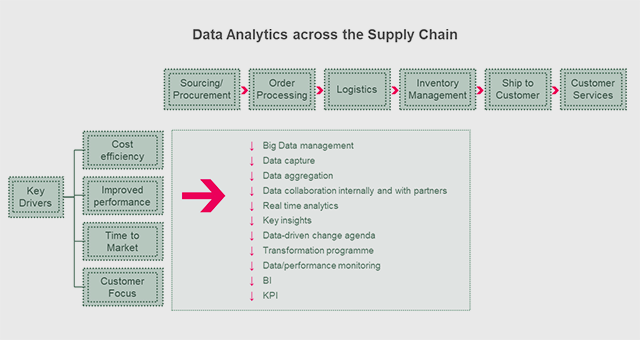

The main area of digitisation is in the Supply Chain, and companies are finding that data and data analytics can be a rich source of innovation. They are especially finding that if they establish an effective eco-system with suppliers and partners and with customers, that they can now take an integrated and complete end-to-end view of parts, process, inventory and distribution, drive hard to a truly just-in-time solution that can provide a win-win-win for all parties and a major reason for partners and suppliers, and also customers, to sign-up, participate and integrate.

Data and data analytics have a key part to play in identifying opportunities and Machine Learning will ramp up innovation opportunities and ideas and raise the bar on what is possible.

Ford, for example, has used its plant in Cologne, Germany as a key hub for eco-system and ”industry 4.0“ innovation and change. The plant manufactures 6 types of engine transmission and also supplies Mazda and Volvo across Europe. Total volumes are more than 1 million transmissions each year and there are a significant number of custom variations. The production process involves many different parts from multiple suppliers located in different countries. All this had created an environment where inventory was high and there were frequent delays due to non-availability of parts and the production process was slower than target.

Ford has now introduced its ”Material Flows Wireless Parts“. This is a wireless messaging infrastructure of 220 RFID (radio frequency identification) tags installed as ”Where Call“ buttons. Each tag is associated with a specific parts number. A core wifi network has been set up throughout the plant, mobile PCs are mounted at key stages on the production and assembly lines and also at staging points in the warehouse and on the fork lift trucks. Press the ”where call“ button and the ”parts needed“ message is immediately directed to the key warehouse area for that part. The supplier is also automatically notified so they can keep track of inventory. They are now responsible for just in time availability and accountable for any failure. As a result of this the assembly line worker stays on station and is trained when to call for replenishment to maintain continuous production. ”It‘s intelligent automation“. Ford are now developing AI techniques that could potentially step-change even this ”where call“ process and develop the predictive modelling that will automatically identify the replenishment timing. So far this initiative has had a 20% improvement in productivity, reduced on-hand inventory to 24 hours, led to a near elimination of down-time and helped forge more effective partnerships with suppliers who now have the visibility and can take more initiative their end as well to improve total supply chain efficiency.

While many manufacturers today are developing and implementing similar real-time inventory management initiatives, others are also looking beyond the production process and at how best to engage the customer to ensure growing demand. One leading example is Cisco. They have been at the forefront in adopting lessons from the B2C environment and enabling their customers to buy anytime anywhere anyhow, a true multi-channel capability.

Cisco are now seen as a leading edge B2B case study in this regard and their journey down this path was kick-started some years ago. This extract below from an interview with Blake Salle, the then Cisco SVP Sales:

”We were doing our annual review and we had one customer who had never purchased from Cisco before and who placed an order online for nearly $100m. The immediate reaction was ”hey, where did that come from!“ and then our second reaction was: ”let‘s get the Sales team down there straight away“. But you know what, when we got in touch, they said ok, no need for your Sales people to visit, just make it easy for us to buy from you.

”What we didn‘t realise in the early days is also just how important it was to appeal to all online customers big and small. Then we saw buyers from small customers naturally joining the larger companies and buyers still at smaller companies suddenly and dramatically increasing their online order size. And of course it‘s a small world and word of mouth is strong. So if we‘d not dealt with them properly when they were small they sure as anything weren‘t going to deal with us when they got big.“

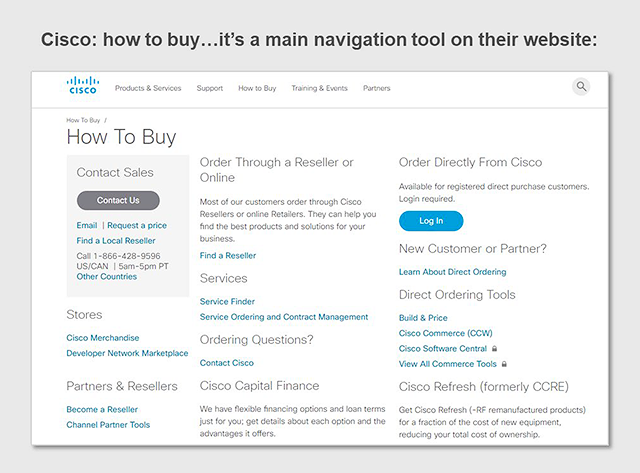

Blake Salle was at the forefront in pushing Cisco into multi-channel selling and still today the Cisco web site is the most B2B sales /buyer friendly and helpful. The main online navigation has at the top level a key tab: ”How to Buy“ and every option is then laid out: call us, click here for our distribution centres and stores, buy through our partners, here‘s a list of our resellers and order directly from them, or buy directly online from us, and by the way here‘s the Cisco App for product specific info and phone numbers for local support near you.

This is a customer /buyer capability which seems so right to set-up and establish but still so many B2B organisations are slow to embrace and implement these sort of initiatives, still relying on the traditional Sales visit to take orders, part implementing new production techniques, still slow to develop open systems and real-time automation in the supply chain, still hesitating about new technology opportunities. It is of course a significant investment to do these things but critical if at all feasible to have the vision and plan and find ways bit by bit to get there, especially if, as Cisco and others are finding, it can open up new sources and ways to drive revenue growth, improve efficiency and cost of delivery and so provide an attractive return and gain.

Article also available for download as a PDF

Related Articles

- Technology vs People: Chapter 1

- Technology vs People: Chief AI Officer

- Finding talent just got easier

- A new 2025 business model

- Quiet Quitting: 7 rules for managing it

- Digital and Data Transformation: 10 keys to success

- Leading B2B companies using digital to power sales & profit growth

- Employee engagement is the key to digital change and transformation

- Evolution of the CDO role: 3 options for success

- Digital evolution of Marketing

- Winning in the talent wars

- Untapped potential of effective Customer Data & Analytics

© Michael de Kare-Silver 2026

Michael runs this specialist and international recruiting /headhunting practice Digital Prospects, helping companies recruit key talent where Digital Tech and /or Data skills and savvy are important.

Michael used to be MD at Argos.co.uk and of Experian.com, he is ex McKinsey strategy consulting and Procter & Gamble marketing, Michael provides a personal and dedicated advisory and recruitment service that delivers results and is built on treating people with kindness and respect.